Why Offshore Trusts Are Becoming Popular Among Digital Nomads

Why Offshore Trusts Are Becoming Popular Among Digital Nomads

Blog Article

Exploring the Trick Functions and Advantages of Utilizing an Offshore Count On for Riches Monitoring

When it comes to wealth monitoring, you could find that an offshore count on provides special benefits you had not considered. These counts on can boost property protection, use tax obligation efficiencies, and keep your privacy. By understanding their vital functions, you can make enlightened decisions concerning your economic future. How do you choose the appropriate territory, and what certain advantages could use to your scenario? Let's discover these important elements better.

Recognizing Offshore Trusts: Interpretation and Function

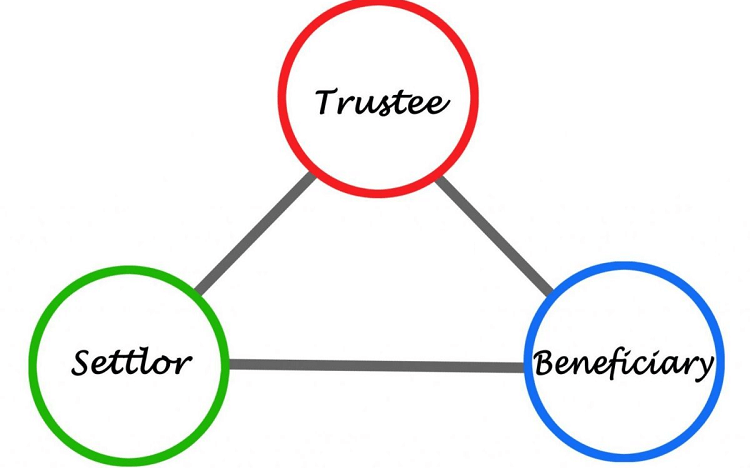

Offshore trust funds function as effective devices for riches management, offering people with calculated choices for possession defense and tax obligation efficiency. These trust funds are legal entities established up in jurisdictions outside your home nation, allowing you to secure your assets from lenders, legal actions, and also prospective taxes. By placing your riches in an overseas count on, you obtain a layer of protection that may not be readily available domestically.

The key function of an offshore depend on is to assist you keep control over your possessions while ensuring they're handled according to your dreams. You can mark recipients, specify just how and when they receive distributions, and also established conditions for asset gain access to. In addition, offshore depends on can boost personal privacy because they often shield your monetary information from public analysis. Understanding these fundamentals can equip you to make informed decisions concerning your wide range monitoring technique and explore the benefits of overseas trusts effectively.

Trick Functions of Offshore Counts On

When thinking about offshore trusts, you'll find 2 standout attributes: possession security techniques and tax efficiency advantages. These trust funds can secure your wide range from lawful insurance claims while likewise maximizing your tax obligation circumstance. Allow's check out exactly how these vital attributes can work to your benefit.

Property Defense Methods

One of the most compelling attributes of offshore depends on is their ability to guard assets from prospective lawful insurance claims and financial institutions. When you develop an offshore count on, your properties are held in a jurisdiction with solid personal privacy regulations and positive regulations. Additionally, offshore depends on usually offer a layer of security against political or economic instability in your home country.

Tax Efficiency Benefits

Establishing an overseas trust not only offers strong possession protection but additionally provides substantial tax performance benefits. By positioning your possessions in an overseas count on, you can take benefit of positive tax obligation routines that many territories provide. Eventually, an offshore trust fund can be a powerful device for optimizing your riches monitoring technique.

Property Protection Perks

Since you're seeking to safeguard your riches, recognizing the asset security advantages of an overseas count on is essential. An offshore depend on can secure your assets from lenders, legal actions, and unanticipated financial difficulties. Offshore Trusts. By positioning your wealth in this structure, you produce a lawful obstacle that makes it hard for others to claim your possessions

In addition, overseas trusts usually run under jurisdictions with robust personal privacy legislations, implying your monetary information remains confidential. This personal privacy can discourage potential plaintiffs or complaintants from seeking your assets.

Tax Obligation Benefits of Offshore Depends On

While lots of investors seek means to lessen their tax liabilities, offshore counts on can provide a critical method for accomplishing tax benefits. By putting your properties in an overseas count on, you might gain from lowered tax depending on the territory's rules. Lots of offshore jurisdictions offer positive tax rates or even tax obligation exemptions, permitting your wide range to expand without the burden of excessive tax obligations.

In addition, offshore trust funds can aid delay tax obligations on capital gains till distributions are made, providing you extra control over when you recognize those gains. You might also be able to shield particular assets from taxes, relying on the trust framework and neighborhood laws. This flexibility can improve your total wealth administration approach.

Additionally, utilizing an overseas trust can aid you browse complicated international tax laws, making certain that you're compliant while optimizing your tax setting. In other words, overseas trust funds can be a powerful device in your wide range monitoring arsenal.

Privacy and Privacy Enhancements

When you set up an overseas trust fund, you gain improved economic personal privacy that shields your assets from undesirable scrutiny. Lawful privacy securities further secure your information from prospective leakages and violations. These functions not just protect your riches yet additionally give assurance as you browse your monetary strategy.

Improved Monetary Privacy

Improved economic personal privacy is just one of the key benefits of developing an offshore trust, as it permits you to secure your possessions from prying eyes. By positioning your riches in an offshore trust, you can considerably lower the danger of unwanted analysis from authorities or the public. This framework keeps your economic affairs discreet, ensuring that your investments and holdings continue to be published here personal. In addition, overseas jurisdictions usually have stringent privacy legislations that further shield your info from disclosure. You obtain control over who has accessibility to your financial information, which helps protect you from potential hazards like suits or economic disputes. Eventually, boosted privacy not just secures your properties but likewise grants you satisfaction concerning your special info monetary future.

Lawful Discretion Securities

Offshore depends on not only give improved financial personal privacy however also supply durable legal privacy protections that secure your assets from external examination. With offshore trust funds, you can protect your wide range against lawful difficulties, creditor insurance claims, and other threats while appreciating the privacy you are worthy of in your wide range administration technique.

Estate Planning and Wealth Conservation

Estate planning and wealth preservation are vital for securing your monetary future and guaranteeing your assets are secured for generations to come. By establishing an overseas trust, you can successfully manage your estate, protecting your wide range from potential lenders and legal difficulties. This aggressive method permits you to dictate exactly how your properties are dispersed, ensuring your dreams are honored.

Utilizing an offshore trust likewise supplies you with numerous tax obligation benefits, which can help maximize your wealth. You can minimize inheritance tax, permitting even more of your wealth to be passed on to your heirs. Additionally, an offshore depend on can secure your properties from political or financial instability, more safeguarding your economic heritage.

Incorporating an offshore count on into your estate preparation method not just boosts wide range preservation however likewise brings satisfaction, understanding that your hard-earned properties will certainly be guarded for future generations.

Choosing the Right Jurisdiction for Your Offshore Count On

Exactly how do try these out you pick the appropriate territory for your overseas depend on? Think about the legal framework. Search for jurisdictions with strong asset security regulations and regulative stability. This guarantees your trust fund continues to be secure versus possible difficulties. Next, assess tax effects. Some jurisdictions offer positive tax therapy, which can enhance your wide range management method.

You ought to additionally examine the credibility of the territory. A well-regarded location can boost reputation and reduce analysis. Consider ease of access also; you want to quickly communicate with regional trustees and experts. Consider any type of language obstacles and cultural distinctions that may influence your experience.

Often Asked Concerns

Can I Establish an Offshore Count On Without a Monetary Consultant?

Yes, you can establish an overseas depend on without an economic expert, yet it's high-risk. You'll require to study lawful needs and tax obligation effects extensively to assure conformity and secure your properties properly.

Are Offshore Trusts Legal in All Nations?

Offshore trust funds are lawful in several nations, yet not all. You'll require to examine the details regulations in your nation and the territory where you prepare to develop the trust fund to assure conformity.

Exactly how Much Does It Cost to Establish an Offshore Count On?

Establishing an offshore trust typically costs in between $2,000 and $10,000, relying on aspects like jurisdiction and complexity. You'll additionally deal with continuous charges for management and compliance, so prepare for those expenditures, also.

Can Beneficiaries Access Funds in an Offshore Trust Fund?

Yes, recipients can access funds in an offshore trust, yet it often depends on the details conditions established by the count on. You ought to review those information to comprehend the access guidelines plainly.

What Occurs if I Move Back to My Home Country?

If you move back to your home nation, you'll require to consider local tax obligation implications and guidelines relating to overseas depends on. It's important to speak with a lawful expert to browse these adjustments successfully.

Report this page